Manifest it!

posted on 20/02/2025

Some thoughts on forecasting, the attention to give to it on the business growth journey and the idea that a result can be manifested

Introduction

Keeping score and knowing where you are is vital for success in any organisation. We have previously highlighted how data savvy professionals are coming out on top in all walks of life not just cycling (Mr Brailsford). See Growth CEOs & data smart cultures

Credit : British Cycling and Dame Laura Kenny

More formally, “users” of statutory financial information get confidence on the preparation of that intelligence from the reporting standards, the contribution from the accounting professionals historically, the law makers and “best practice”. A regulated environment where company management can implement “statutory standard” monthly reporting that benefits governance and onward reporting to external stakeholders.

Beyond the primary statements, an increasing narrative is emerging on what is a “data rich” environment and the interpretation of data and KPIs. A plethora of memes on smart use of KPIs has appeared on social media such as LinkedIN and Instagram such as @data.chatter below. https://www.instagram.com/data.chatter/

This is all a positive contribution to how we understand and compare businesses or take away from the literature or social media out there. On top of this we see great work done by data savvy professionals promoting their software and services. All vital input for growth and success but today we wish to draw attention specifically to forecasting and how this supports the understanding of the financial and non-financial (commercial) activity within the business.

Forecasting

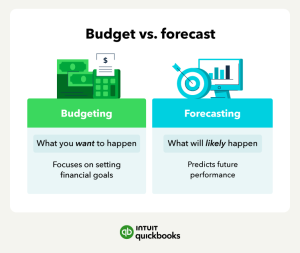

Trading effectively involves planning and implementation of tactics to deliver the required strategic result, a journey plan you might say. Weaved into our implementation of the plan is forecasting, it’s how we interpret the changing environment around us and adjust the original journey plan. Before that we need to revisit where it sits in the overall budgeting process.

Credit: Intuit quickbooks

https://quickbooks.intuit.com/r/running-a-business/budget-vs-forecast/

The key control tool

Given that we want to deliver a certain outcome from an investment or project the finance text books tell you that the number one control is “budgeting”. The process by which we forecast, review and thus control and improve.

The forecast bit is where we anticipate likely changes to the environment affecting income, expense, asset movements or maybe funding. We periodically review actual performance against our projection and seek to understand where the variances. This circular and iterative stage of the process gives improvement in our understanding of performance and improvement in control.

Often simply called the “budget” or the “plan”, the books don’t lie, this is the core control tool, in any trading environment you will want to review the current activity against what was expected testing the accuracy of original assumptions.

We were very pleased that this got an increased profile in the 2024 word of the year choice made by the nice people at Cambridge Dictionary. The word “manifest” got a refreshed and more current definition as follows:

“to use methods such as visualization (= picturing something in your mind) and affirmation (= repeating positive phrases) to help you imagine achieving something you want, in the belief that doing so will make it more likely to happen”

So the budget or annual plan is an attempt to “manifest” a certain outcome.

Development of forecasting and the “forecaster”

No one around here can remember forecasting as a concept getting much syllabus space to any extent at college, university or on the accounting or banking professional training routes. Yes it was mentioned but not really elaborated on and never any training on a practical application that a potential new boss might recognise to get you through the interview for an analyst role or internal move.

Forecasting has thus been historically left to the individual to develop their skillset based on their accounting training, a lone ranger in manifestation. Rarely do we see a non-financial manager build forecasting into their toolkit and even amongst the finance team, forecasting is often left to the person within the finance team with stronger spreadsheet skills.

The “forecaster” is not a role in itself, routinely it’s swallowed up by the FP&A team, an analyst, treasury , systems accountant or group financial controller as part of their role, possibly because of their skills or position at the intersection of the teams or departments that are corralled in the budget or forecast processes (Often these routines make use of the same communication channels and methods).

I hope lots of colleges or training establishments will pull us up on our reflection that forecasting didn’t get a look in on the syllabus and we will gladly give space to their offering in an updated version of this blog.

For now, we are saying we are happy to give more profile to forecasting, it’s link to valuable budgets, to enriching commercial conversations across departments and the tools out there to make it happen.

People & Intelligence

Maybe we can encourage a step change in the learning environment and the elevation of forecasting as a subject matter in itself.

Alongside this we must highlight that good forecasting results from a competent skillset and systems and very importantly “intelligence”. By intelligence we mean quality communication links and relationships between the “forecaster” and the sources of numerical or commercial information.

So the forecaster will need spreadsheet or system skills, accounting knowledge, intelligence (meaning data coming from connection to other departments here) and large dose of emotional intellect to distil the intelligence into a simple-to-communicate interpretation of likely future events. The ability to build and maintain relationships with non-financial managers is key to forecaster success.

We see most companies at some stage along this reconciliation of finance personnel’s understanding of financial control objectives (inc forecasting) to how it is seen by their non-financial counterparts. (maybe another post on its own).

The emotional intellect can take different forms, but the forecast has to forge relationships with non-financial managers such as the head of sales and head of operations/ production. We have seen this connection fostered by something as simple as sharing a cigarette break ( less healthy than a water fountain moment we know, but from nothing we evidenced a divisional FC build a link to operations never before thought possible ).

The forecaster can’t deliver in isolation, we are advocates of the idea of sharing the airport-book “ finance for non-financial managers” within managers helping the forecaster approach to receive a soft landing.

Similar to our succession planning message, see Can you multitask?, we think that the ambitious accountant will pick up valuable skills and develop relationships during a secondment or sideways step to occupy the forecaster role, adding skills that will help in interviews for more senior roles in days to come.

Again the win for the company is to rotate staff into the role to give coverage on the skillset and also wash it around the business thereby enhancing group forecasting as the secondee takes the skills back to their department, it’s win win.

Examples of what’s out there

Firstly it’s about timely, accurate and relevant information commensurate with the scale of the operation and the keep it simple adage reigns.

Many groups of significant scale continue with spreadsheet forecasting content with the flexibility within, the ease of adoption of such within non-financial managers now and appropriate controls, checks and balances. It works with minimal disruption and application

The forecasts are more often headline numbers only, income statement focused giving a view on sales, GP and net profit. Less often are they prepared with a balance sheet emphasis and cash generation. Other applications include forecasting prospecting pipelines.

Dissenting for a moment, can a business operate without budgeting?. Well no. It will change from business to business depending on scale and complexity but no one seriously begins a journey without some anticipation of what to expect along the way and at the destination. (The journey analogy is a repeatedly used communication tool here at small harbour, intrinsic within our name, a manifestation of strategically where we want to be).

Writing this after many years engaged at all levels, including managing resources 12 hours away, the success of the forecasting process is linked to your resident culture and the discipline of the team. For now, we are sans AI, and it’s your key leaders who drop the fairy dust into the forecasting hopper and digest the outcomes. Strong leaders can integrate forecasting into other control mechanisms such as daily communications, department meetings, 1-2-1 reviews and really give it sufficient bandwidth.

Single Use

We see the forecast data often dumped one week to the next as the management get comfortable with what it tells them and react to any potential “red flags” within. “Single Use”

We see less attempts to correlate weekly forecasts for example to any prior forecast and how perhaps one source or data is repeatedly more accurate than another, rolling out the lessons from that analysis.

We do come across slick forecast systems updated weekly, stored in data cubes (and consolidation software like Hyperion), rich in default reports with intelligent comparison of input source accuracy, notes on variances/anomalies and feedback routines.

More simple forecasts are more commonplace, from finance department origins and we have shared a much used short term cashflow template “STCF” before. We see more trading groups deploy something similar to this on a rolling 13 week basis and consolidate the returns from divisional input up into a group position including the handling of different currencies. We are happy to guide you through how this can be set up.

Systems

The provision of systems in this area is growing as software houses recruit “forecasters” polished in the application side and wash that into their product offering. The ability to tap into SaaS (software as a service) then makes the entry point attractive even for the smaller organisations.

Businesses going through step change transactions may have benefited from engaging the corporate finance teams within their accounting relationships who bring rigour to this area and may leave tools that can be readily maintained internally post transaction. (Again mostly spreadsheets)

Where external equity providers like VC or PE are involved they will bring analysts (or sub contract forecasters) to devise any necessary tools on forecasting to fill gaps and support their engagement/investment decision. To a degree this gets adopted but has to pass the operational empathy test outside the finance function to a become habitual.

We often see these tools rest in the finance function only and whither post the investment round due to time cost to maintain or obsolescence (perhaps the risk area under the spotlight no longer exists)

Finally, the end of this particular journey

Forecasting is no longer overlooked by companies and professional advisors and left outside of the financial reporting systems.

The best CFOs feed the forecasting education process and build relationships and understanding amongst the non-financial managers making the environment outside of the finance function increasingly receptive to the information and time demands of a best in class reporting and forecasting system.

Talented finance personnel are rotating in and out of the forecaster role to build their profile in the group, develop a greater understanding of forecasting and ultimately benefit the value of the forecasting itself and its knock on value to the budgeting process, senior FP&A duties, internal and external reporting and enhance the data content in commercial conversations in the business.

Lets be clear this is value add behaviour for the business owner or CEO , the investment to integrate appropriately scaled, simply maintained and commonly understood forecasting routines adds material value to the business.

It builds the teams knowledge of the trading activities, it augments the human interaction in all financial control areas (connecting the non-financial and finance teams) and as such the internal and external reporting leaps forward. The business as a hole moves up the scale of data richness with all the merits that holds in the business growth journey.

If you wish to explore any of the areas covered here, please contact us here Contact